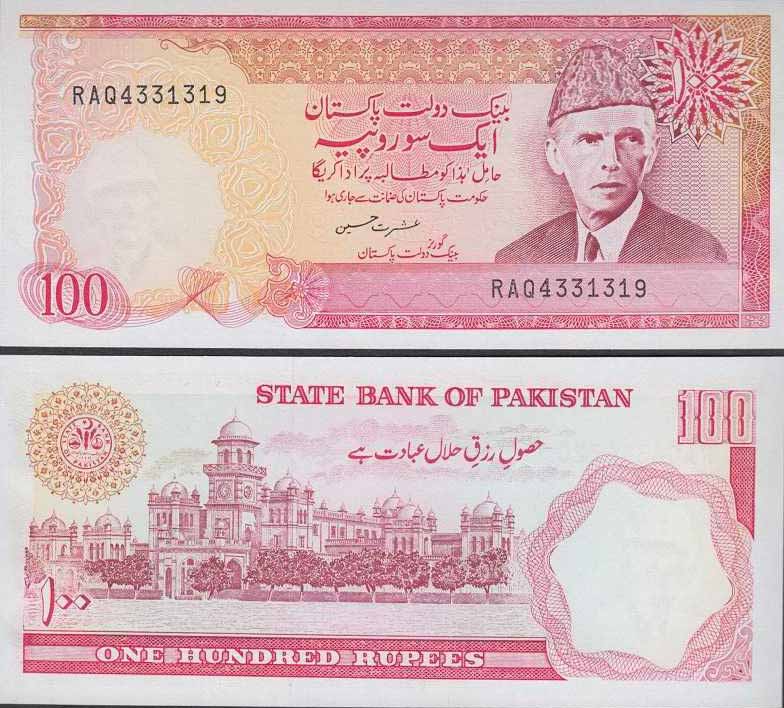

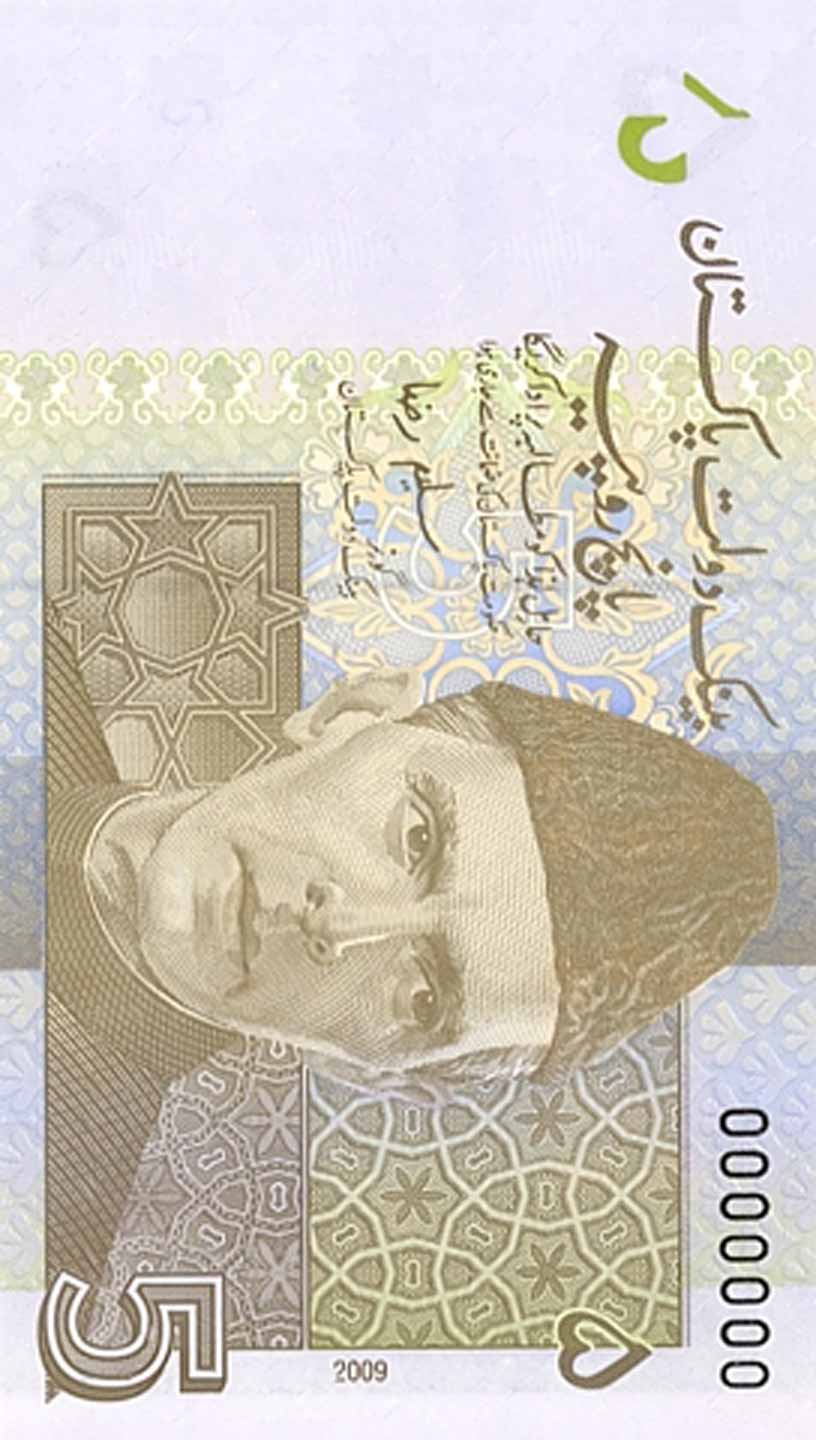

Central bank of Pakistan is the "State Bank of Pakistan". State bank of Pakistan (SBP) was established on 1st July 1948. Quaid-i-Azam Muhammad Ali Jinnah performed its opening ceremony. Currently State Bank of Pakistan is working under State Bank of Pakistan Act, 1956.

SBP Internal Working

Board of Directors consist of:

- The Governor (Chairman)

- Secretary, Finance Division

- Government of Pakistan

- Eight directors, including at least one from each province appointed by the Federal Government.

Board is responsible to define and determine policies and oversee foreign exchange reserve management and approve strategic investment and risk policy.

The Board is required to submit a quarterly report to the Majlis-e-Shoora (Parliament) on the state of the economy with special reference to economic growth, money supply, credit, balance of payment and price development.

Monetary and Fiscal Policies Co-ordination Board

Co-ordination Board

- Federal Minister for Finance (Chairman)

- Federal Minister for Commerce or Secretary, Ministry of Commerce (Member)

- Deputy Chairman, Planning Commission (Member)

- The Governor (Member)

- Secretary, Finance Division Government of Pakistan (Member)

- Two eminent macro or monetary economists with proven record of research and teaching to be appointed by the Federal Government.

Functions of Co-ordination Board

- coordinate fiscal, monetary and exchange-rate policies;

- ensure consistency among macro-economic targets of growth, inflation and fiscal, monetary and external accounts;

- meet for the purposes of clauses (a) and(b) before the finalization of the budget to determine the extent of Government borrowing from commercial banks.

- meet on a quarterly basis to review the consistency of macro-economic policies and to revise limits and targets set at the time of the formulation of the budget.

- consider limits of the Government borrowing as revised from time to time in the meetings to be held before and after passage of the annual budget;

- review the level of Government borrowing in relation to the predetermined or revised targets after every quarter; and

- review the expenditure incurred in connection with raising of loans and Government borrowing

Monetary Policy Committee

Monetary Policy Committee

- Governor (Chairperson)

- three senior executives of the Bank (Members)

- three members of the Board (Members)

- three external members (Members)

Functions of Monetary Policy Committee

- formulate, support and recommend the monetary policy, including, as appropriate, decisions relating to intermediate monetary objectives, key interest rates and the supply of reserves in Pakistan and may make regulations for their implementation;

- approve and issue the monetary policy statement and other monetary policy measures;

- perform any other functions conferred on it by law.