MONITORING PERFORMANCE

PERFORMANCE

It is very important to monitor a wide range of “performance indicators” in your business, in order to ensure that appropriate and timely decisions and plans can be made.

Given that sales, profit margins and cash flow are the lifeblood of any business, owners should place particular emphasis on receiving regular reports on these areas of the business.

Knowing the financial position becomes even more important as the business grows, especially if your plan is to grow the business substantially.

Lack of a precise and timely knowledge of the current financial position can lead to business failure and have other consequences for the directors/owners.

FINANCIAL STATEMENTS

The minimum financial information for any business should be periodic financial statements consisting of at least a Balance Sheet and Profit and Loss Statement.

Businesses that provide credit to customers also need to control their debtors through monthly aged debtors trial balances.

Those who have a significant investment in stock should control that through perpetual inventory records.

Regular debtor and inventory reports will help prevent too much capital being tied up in these areas and allows for prompt follow up action. For example changing inventory ordering patterns and allowing immediate follow up on debtors to prevent bad debts.

Examples are number of enquiries, number of customers per day, average sales value, number of quoted jobs lost, customer satisfaction and so on.

One disadvantage of financial statements is that they show the results of the business after the event and as such they are a lag indicator.

If prepared solely on an annual basis (and often this happens well after the end of the year) there is a considerable lag. More frequent reporting periods are needed for more important data as well as use made of other financial and non-financial indicators.

Examples are number of enquiries, number of customers per day, average sales value, number of quoted jobs lost, customer satisfaction and so on.

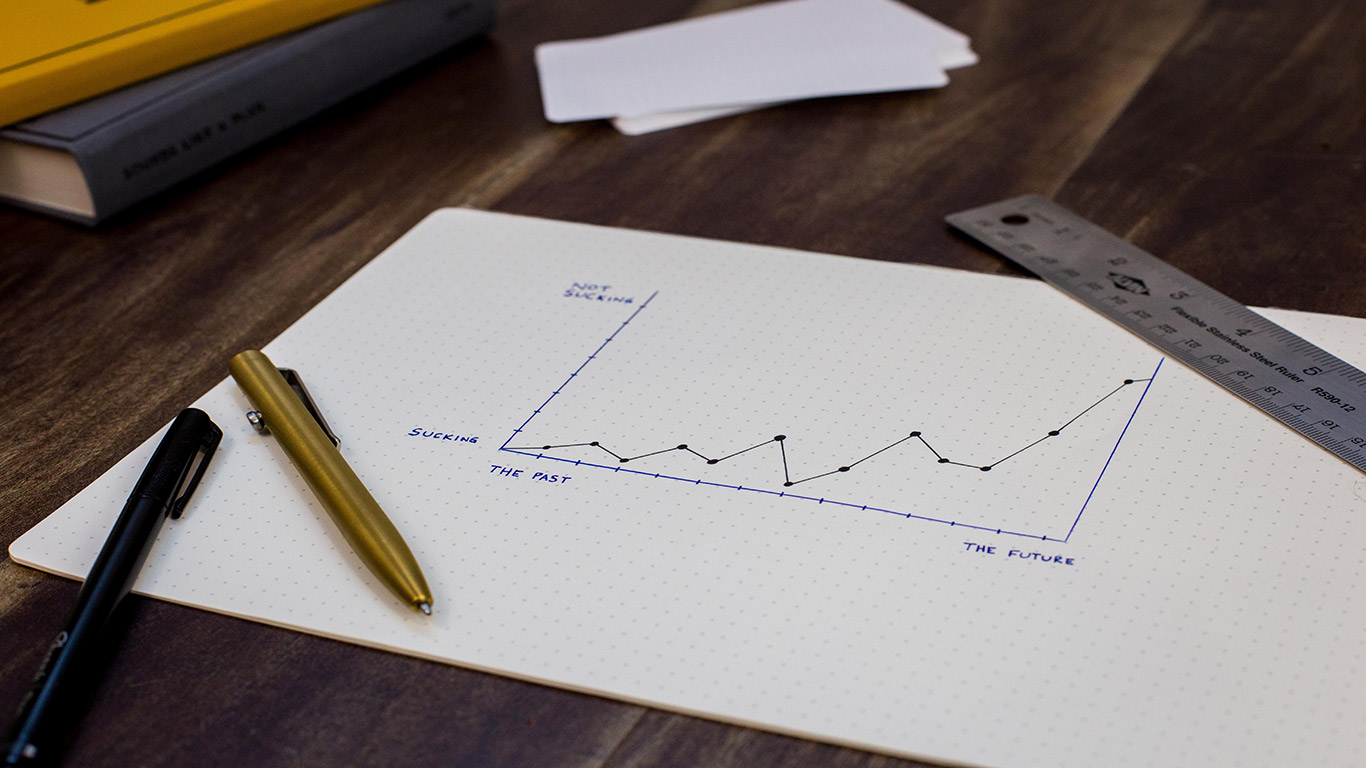

Thus for best results, financial statements and other key performance indicators (KPI’s) should be prepared on a regular and consistent basis and compared with prior periods. Monitoring performance using successive monthly or quarterly accounts can show trends that otherwise might not be apparent.

Important KPI

STOCK TURNOVER – DAYS

Reflects the number of days that it takes to sell inventory. The lower the ratio means the quicker the stock is sold

DEBTORS TURNOVER – DAYS

Reflects average length of time from sale to cash collection. The lower the ratio means the quicker that accounts are paid. From a cash flow perspective, it is important to keep days outstanding to a minimum.

CURRENT RATIO

Indicates the extent to which current assets cover current liabilities and is a measure of the ability to meet short term obligations. The rough rule of thumb is a ratio of 2:1. That is for every 1 rupee of liabilities (within 12 months), there should be at least 2 rupee in current assets to meet such liabilities.

DEBT/EQUITY

This is a measure of the extent to which a business relies on external borrowings to fund its on-going operations. The higher the ratio, the more heavily that debt financing is used. In order to provide a reliable measure, assets should be valued at market value.

INTEREST COVERAGE

Provides a measure of the ability of the business to meet its interest commitments out of profits and is linked to the debt/equity ratio. The rough rule of thumb used by banks is a ratio of 3:1. That is, operating profit before income tax exceeding interest expense 3 times.

RETURN ON INVESTMENT

Represents the after-tax return that owners are receiving on their investment and should be compared with alternative forms of investment.

GROSS PROFIT MARGIN

An indication of the profitability of the business and reflects control over cost of sales and pricing policies. This ratio should be compared with prior periods and to any available industry data.

BREAKEVEN SALES

Reflects the sales that need to be generated in order to cover expenses. In other words, this is the level of activity at which neither a profit nor loss is incurred, or where total costs equate with total revenue. This is a very important ratio that every owner should monitor on a monthly basis.

PROFIT & LOSS AND CASH FLOW BUDGETS

Business owners should also prepare monthly profit & loss budgets for at least a 12 month period and more importantly to assess the impact that these projections have on the future cash flow of the business. Budgets should be compared to actual results and variances acted upon on a timely basis.

For more accurate reporting, particularly in respect of manufacturers, wholesalers and retailers, it is preferable that the profit & loss and cash flow budgets are linked and have a number of in-built features including:

- The profit & loss budget should have columns that separate income and expenses that include GST or have no GST. Note the amounts in the profit & loss budget are recorded on a GST-exclusive basis, whereas on the cash flow budget, they appear on a GST-inclusive basis.

- The cash flow budget should automatically calculate GST owed to the ATO depending on whether the business is using either monthly or quarterly GST reporting and whether GST is paid on either a cash or accruals basis.

- It is common for operating expenses on the profit & loss budget to be amortised evenly during the 12 month period and the cash flow budget records these payments on either a monthly or quarterly basis. For example rates & taxes, insurance, light & power, and fringe benefits tax are usually paid quarterly, whilst all other operating expenses are usually paid monthly.

- By entering an interest rate, the profit & loss budget should have the facility to calculate interest paid each month on the overdraft, or interest received where the account is in credit at the end of the month.

- Opening balances (e.g. bank overdraft/credit balance, GST liability/refund, debtors & creditors) need to be recorded on the cash flow budget.

- The collection and payment percentage rates for debtors and creditors (e.g. current, 30 days, etc) should be recorded to better reflect the impact of sales and purchases on the cash flow budget.

The cash flow budget should include common items such as PAYG instalments/income tax, loan repayments, plant & equipment purchases, dividends, and loans made to the business.